Dear Chiefs,

Please find below, an article regarding the trend in an increase of wage and hour claims across the nation. The trickle-down effect has found its way into several of our member fire districts. It is very important that you are aware that the reimbursement of wages are a Policy Exclusion; therefore, there is no coverage or defense that will be provided through FAIRA.

This is why we strongly suggest that you are proactive in understanding your responsibility as an employer.

http://www.wagehourlitigation.com/overtime/another-year-another-high/

Another Year, Another All-Time High for Wage and Hour Litigation

Posted in Overtime

Co-authored by Richard Alfred and Kevin Young

Co-authored by Richard Alfred and Kevin Young

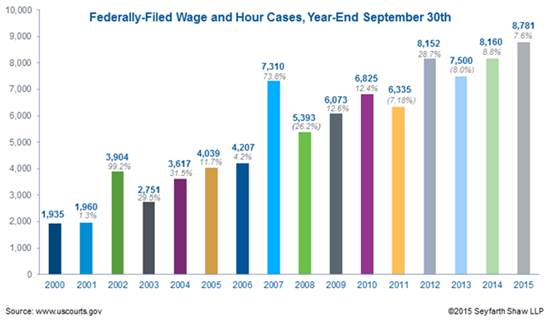

Wage and hour litigation continues to soar to record highs. So says the federal judiciary’s most recent data on cases filed in federal court over the last federal fiscal year. After hitting an all-time high of 8,160 in FY14, the annual wage and hour caseload spiked another 7.6%—to 8,781—in FY15. In federal court, employers are more likely to face wage and hour claims than any other form of employment litigation.

The following graph tells the story:

As the graph depicts, this year’s increase in wage and hour litigation continues the year-over-year explosion in these cases over the past fifteen years. Since 2000, the incidence of wage and hour federal court filings has skyrocketed by more than 450%. During the past decade alone, such filings have increased in eight out of ten years. This year’s total of 8,781 cases is more than any two pre-2005 years combined.

Several factors have fueled the increase in wage and hour lawsuits over the past year. They include:

- The DOL’s June 2015 proposal to revise the “white-collar” exemption regulations has invited increased attention to wage and hour issues. We expect the new regulations to be issued next fall. As we’ve discussed before, the new rules threaten to dramatically increase the exemptions’ minimum salary level, index that salary level to provide further annual increases, and, possibly, to change the exemptions’ duties tests.

- Legal developments impacting independent contractor classification and joint employer status have led to a substantial rise in claims under these theories. These developments have included: (i) the Wage & Hour Division’s July 2015 Administrator’s Interpretation on independent contractors, which seeks to curtail employers’ ability to engage workers on this basis; (ii) the NLRB’s August 2015 BFI decision, which expands joint employer status under the National Labor Relations Act; and (iii) a number of highly publicized lawsuits against “on-demand” employers, such as Uber, that challenge business models reliant on the use of independent contractors.

- Federal court cross-currents affecting the legal requirements for class and collective certification have led to a sharp rise in individual wage and hour claims following large class decertifications, and, at the same time, to a resurgence in class actions as plaintiffs’ counsel and some judges find ways to end-run the limitations set by the Supreme Court in Dukes, Comcast, and other precedent-setting opinions.

- Continued talk of raising the federal minimum wage in the private sector, and of increases in the minimum wage at state and local levels, have further increased the focus on wage and hour issues.

These factors have added to those that we have reported on in past years (May 2013 and May 2014), which have sustained the surge in wage and hour lawsuits:

- The FLSA is an old Depression-era statute created more for smokestack industries, where shifts started and ended with the sounding of a whistle, than for the modern workplace, where application of the Act’s mandates is often confusing and difficult.

- Many of the terms essential to the FLSA were ill-defined, or not defined at all, when the law was enacted in 1938 and the DOL’s regulations were adopted soon thereafter. Those terms remain ambiguous today, leaving businesses with uncertainty and employees with the ability to second-guess their employers’ decisions.

- State laws have provided additional sources of litigation, often regarding pay and other workplace practices not covered by federal law but often combined with FLSA claims.

- Employees have become increasingly aware of their ability to sue for perceived management missteps in exempt status classifications, hours worked or off-the-clock claims, and overtime pay calculations.

- Influenced by large settlements and court awards, plaintiffs’ lawyers have found wage and hour claims to be fertile ground for large fee recoveries.

With more developments in wage and hour laws on the horizon, we expect to see the upward trend continue in the coming year. Now more than ever, employers are well advised to audit their exempt status classifications, independent contractor classifications, and pay practices with experienced wage and hour counsel to identify and mitigate legal risk.

Jillian Stoorza

Executive Assistant

FAIRA

1255 Battery Street

San Francisco, CA 94111

415-536-4005 Telephone

855-350-7617 Toll Free

415-536-8499 Fax